HSA-Eligible High-Deductible Health Plans - University of Michigan

$ 27.50 · 4.8 (619) · In stock

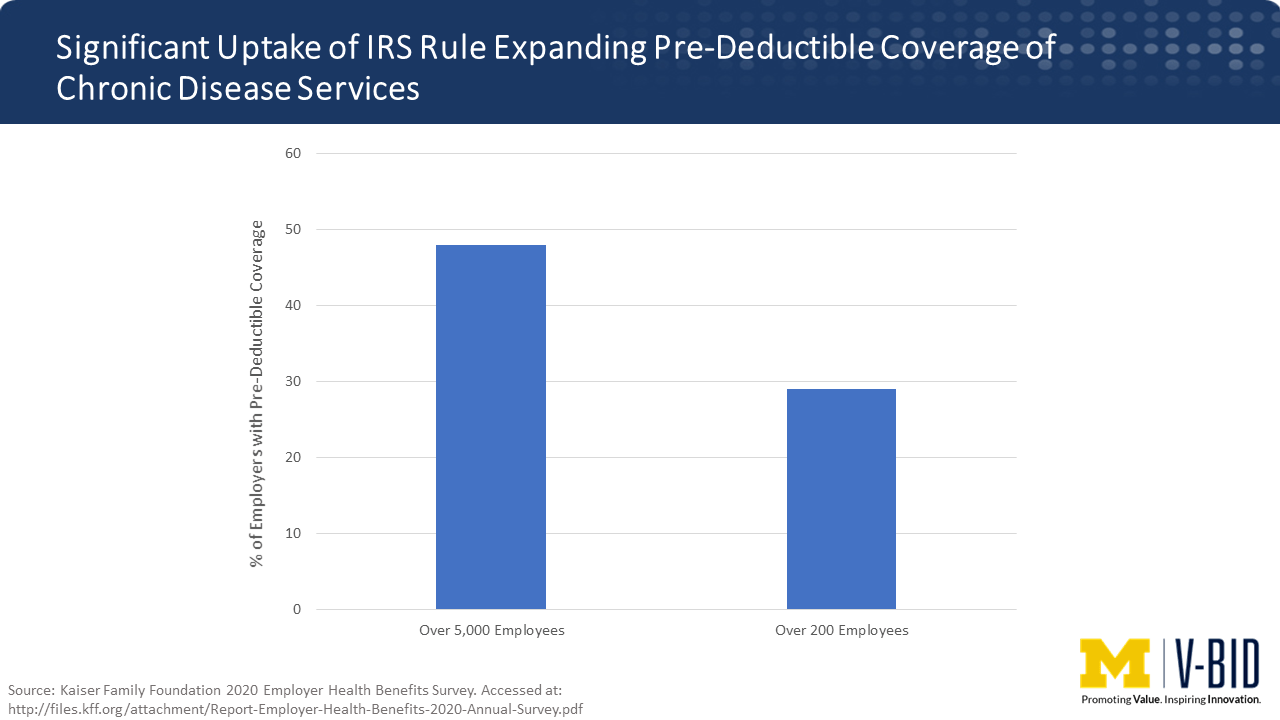

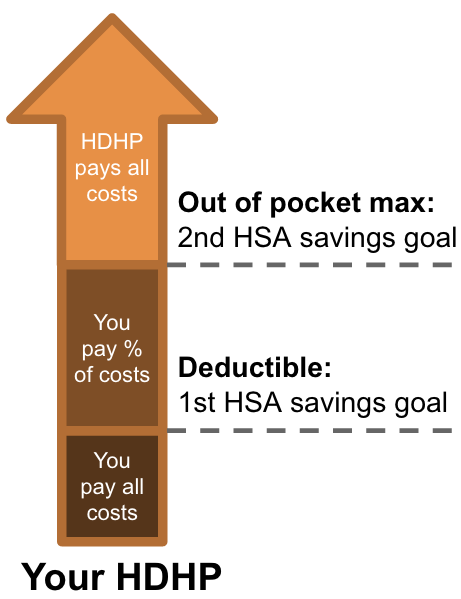

In April 2021, the Chronic Disease Management Act of 2021 (CDMA) was introduced in the United States Senate (S. 1424) and House of Representatives (HR. 3563). This bipartisan bill builds upon previous versions of CDMA and follows a guidance issued by the US Department of Treasury in 2019 to further increase the flexibility of HSA-HDHPs to cover chronic disease services on pre-deductible basis. The 2020 Kaiser Family Foundation Survey reported that of employers offering an HSA-qualified health plan, 48% of employers with over 5000 employees and 29% of employers with over 200 employees reported implementing a benefit design that expanded pre-deductible coverage. Smarter Deductibles, Better Value: Expanding Coverage in HSA-HDHPs High-deductible health plans paired with a tax-free health savings account (HSA-HDHP) represent a growing percentage of plans offered on the individual and group market. HDHPs have defined minimum deductibles and maximum out-of-pocket limits. As of 2017, 43% […]

High-Deductible Health Plans, Explained

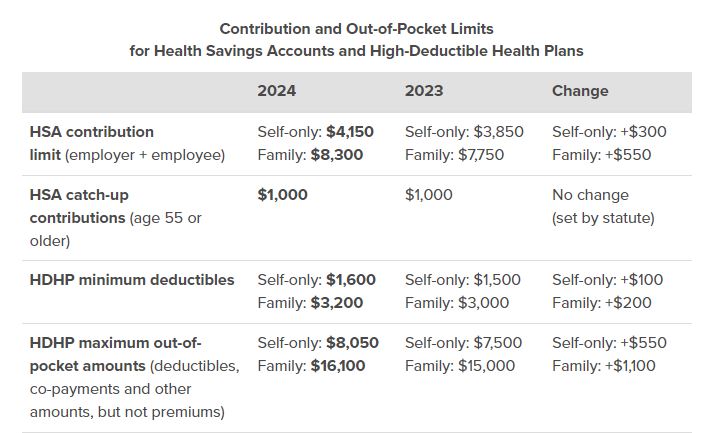

REMINDER: IRS Raises Health Savings Account and High Deductible Health Plan Limits for 2024 - NARFA

Executive order targets healthcare price and quality transparency, and HSA/ FSA changes

Should you switch to a high deductible health plan (HDHP)?

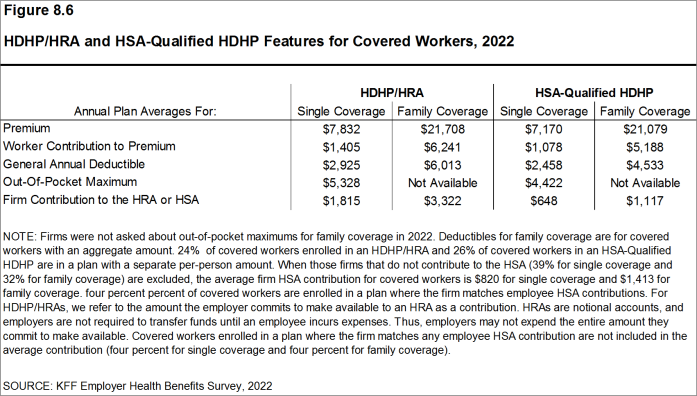

Section 8: High-Deductible Health Plans with Savings Option - 10020

Use of Health Savings Accounts to Save for Health Care Expenses

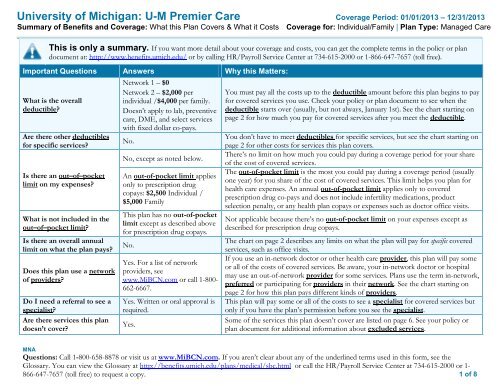

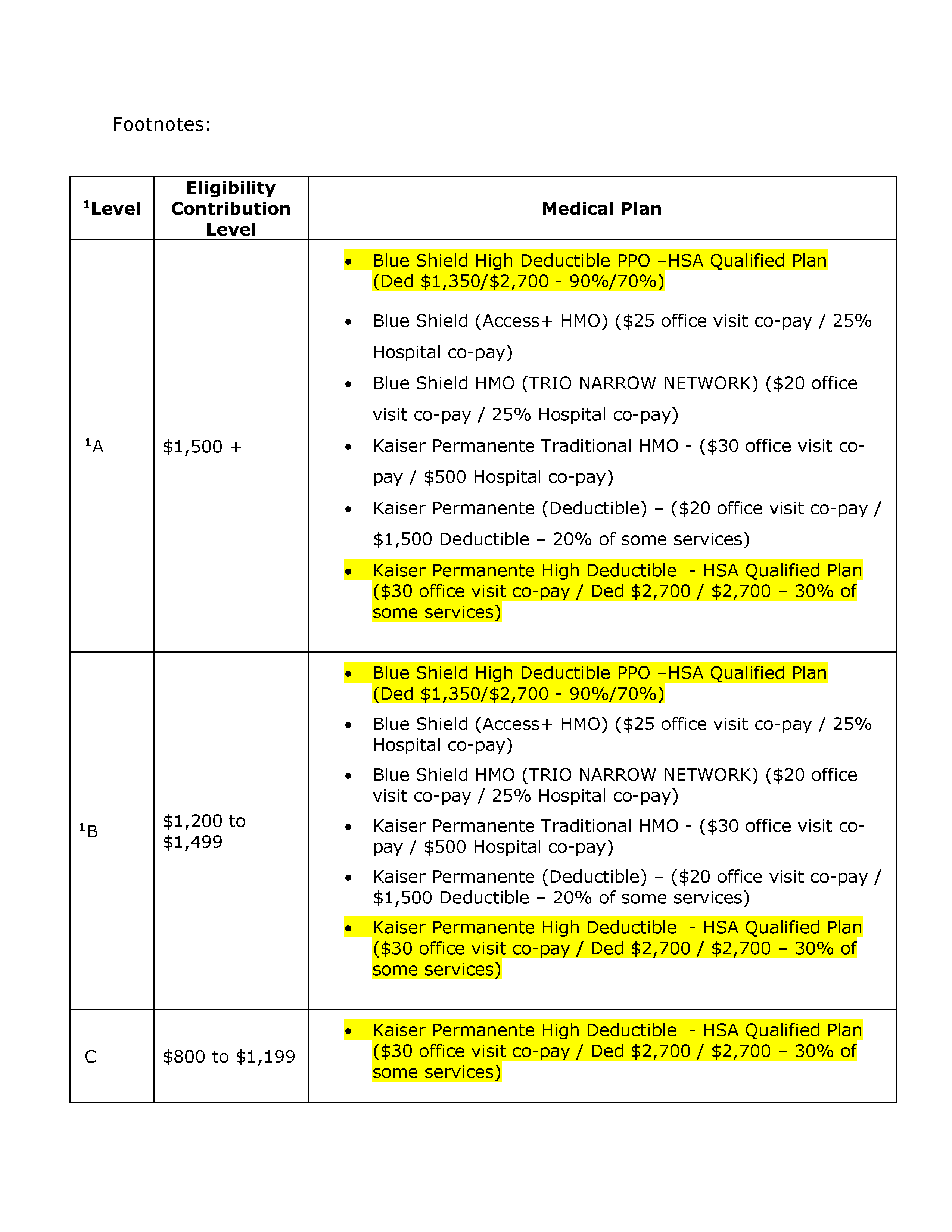

University of Michigan: U-M Premier Care - Benefits Office

H&W: Health Savings Accounts and High Deductible Plans, 47 Blog

5 things you can't use your FSA or HSA to pay for

Health Savings Accounts: Contribution Limits, Eligibility Rules, Benefits

In Defense of High-Deductible Health Plans

HSA-Eligible High-Deductible Health Plans - University of Michigan V-BID Center

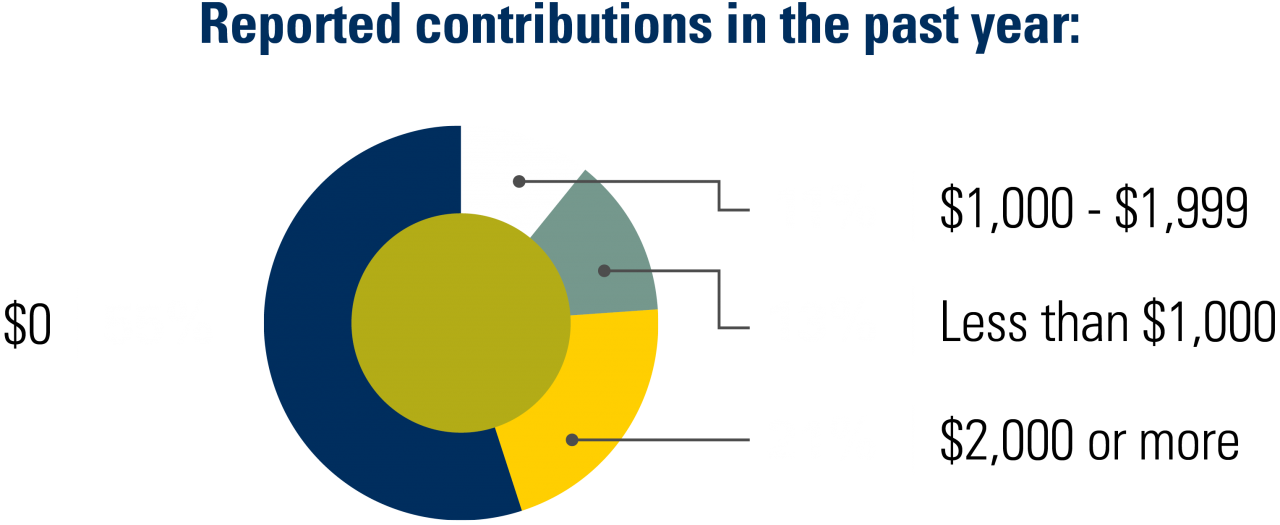

Helping people save for health costs: Poll fi