CRA Travel Expenses For Employees - Travel Expenses Rules For 2024

$ 17.00 · 4.5 (640) · In stock

Need to know how to receive travelling expenses reimbursement from your employer? Learn about CRA travel expenses and if they are taxable as part of your income.

A Guide To Employee Travel Expenses, Blog

NPS new rule: Partial withdrawal of pension from February 1; check process - Hindustan Times

Business Travel Expense Report Template - TravelBank

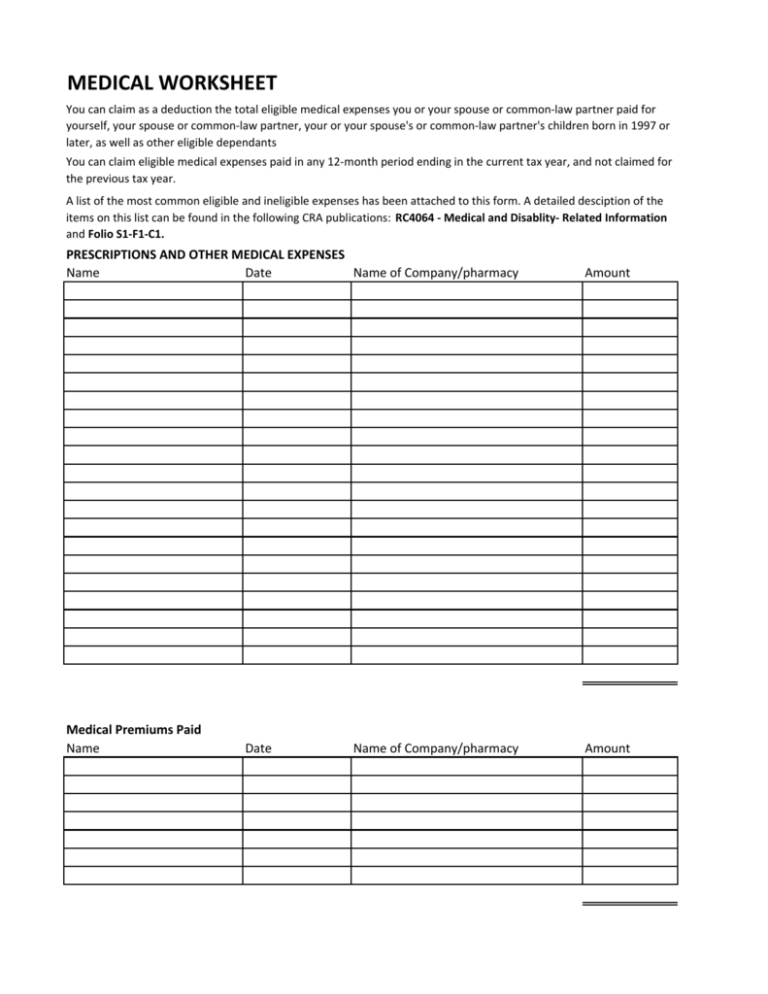

Which medical expenses are not eligible?

Timeero - CRA Mileage Rate: A 2024 Guide - Timeero

Be aware of your tax deductions, CRA advises northerners

Home Office Expenses - How to use the CRA Calculator? & How to use UFile to prepare your tax return?

Government Employee? NPS Tier II tax saver scheme guidelines released - Income Tax News

Tax Exemption: Your official tour daily allowance will be taxed if you don't have bills

New CRA rules around work from home make it harder to claim expenses

Travel Expense Form - 15+ Examples, Format, PDF

What You Need to Know: Business Travel Expenses