High-Low Method Definition

$ 34.99 · 5 (321) · In stock

:max_bytes(150000):strip_icc()/high-low-method-4195104-4x3-01-final-1-4a515f17b88946c89aea45241a23dc1e.png)

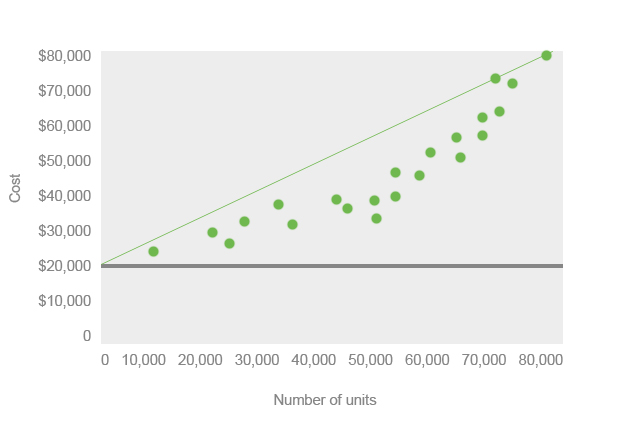

In cost accounting, the high-low method is a way of attempting to separate out fixed and variable costs given a limited amount of data.

What is the High-Low Method? - Definition, Meaning

The High Low method

Web Results: High-Low Method Definition - Investopedia, PDF, Financial Accounting

Web Results: High-Low Method Definition - Investopedia, PDF, Financial Accounting

Fixed Cost Formula + Calculator

:max_bytes(150000):strip_icc()/terms_c_cost-volume-profit-analysis_Final-c64baee383cd4154b5fc2715e3e1dbb7.jpg)

Cost-Volume-Profit (CVP) Analysis: What It Is and the Formula for Calculating It

1 Cost behaviour. 2 Introduction Determining how cost will change with output or other measurable factors of activity is of vital importance for planning, - ppt download

High-Low Method: Solve for Variable Cost per Unit

i.ytimg.com/vi/BzVEVXirIrY/hq720.jpg?sqp=-oaymwEhC

Cost behavior: Decoding Cost Behavior using the High Low Method - FasterCapital

Pricing strategy: Aligning Pricing Strategy with the High Low Method - FasterCapital

MA High/Low