Millennial Money: Navigating the SSI 'marriage penalty', National

$ 11.50 · 4.5 (71) · In stock

For people who rely on Supplemental Security Income, or SSI, getting married can result in reduced monthly benefits and a lower amount allowed for savings. Individual SSI recipients can own up to $2,000 in resources, while couples can have a combined $3,000. Though these limits can dissuade some couples from marrying, exemptions for assets such as primary residences and wedding rings can help bypass these kinds of restrictions. Social Security programs such as Plan to Achieve Self-Support and Achieving a Better Life Experience also offer flexible savings avenues.

LSU's College World Series win drives Louisiana sports betting revenue

How Carey Mulligan became Felicia Montealegre in 'Maestro' – Winnipeg Free Press

Solemn monument to Japanese American WWII detainees lists more than 125,000 names - Richmond News

Atmos Energy Hits Highest Customer Satisfaction Score Since 2018, as Energy Utilities See Gains, ACSI Data Show, Business & Finance

The Mecklenburg Times, March 26, 2024 by SC Biz News - Issuu

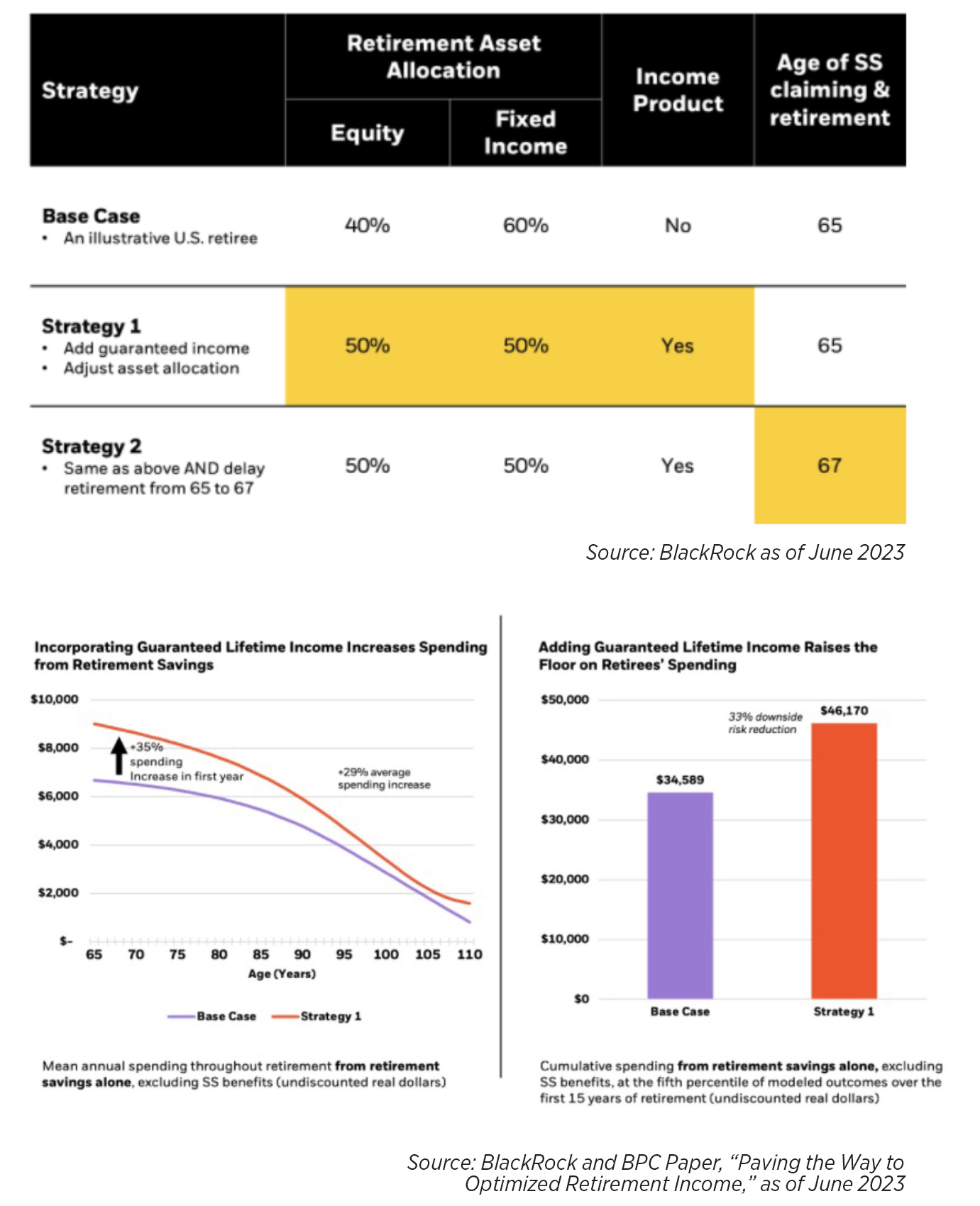

How annuities optimize retirement income - Insurance News

How annuities optimize retirement income - Insurance News

Millennial Money: Navigating the SSI 'marriage penalty', National

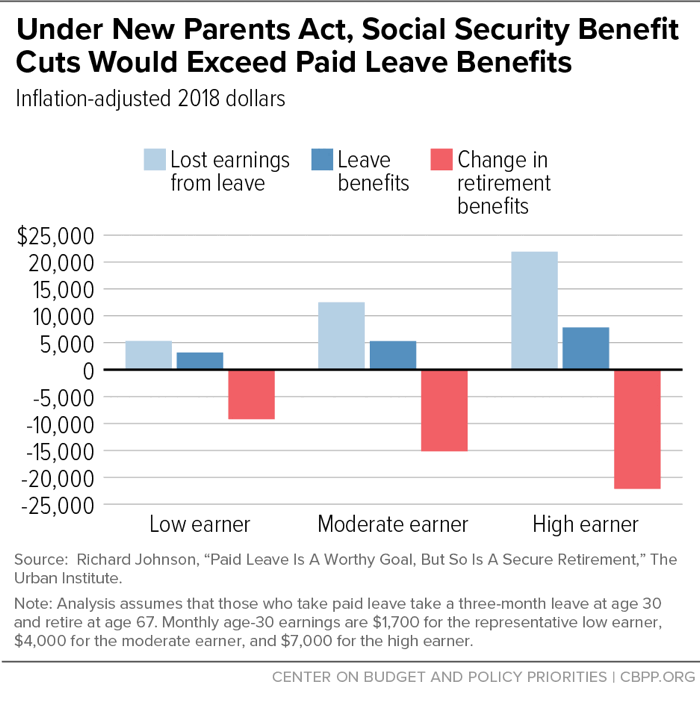

Cutting Social Security to Offset Paid Parental Leave Would Weaken Retirement Security

The Mecklenburg Times, March 26, 2024 by SC Biz News - Issuu

March Madness: Top seed UConn cruises past Northwestern in title defense

Millennial Money: Navigating the SSI 'marriage penalty' - The San Diego Union-Tribune