Capital Gains: Definition, Rules, Taxes, and Asset Types

$ 30.00 · 4.5 (722) · In stock

:max_bytes(150000):strip_icc()/Capital-gain-2e9b43786c824dba8394bf73bd77f81e.jpg)

A capital gain refers to the increase in a capital asset

How to Save Capital Gain Tax on Sale of Commercial Property?

ECONOMICS 110 : - CBU

:max_bytes(150000):strip_icc()/GettyImages-1455343084-7c3f06178d5b4542877f21112a21d8b2.jpg)

Capital Gains: Definition, Rules, Taxes, and Asset Types

Capital Gains and Losses Cassie Warren. Does capital gain count as income for that year on your taxes If your capital losses exceed your capital gains, - ppt download

The Basics of Capital Gains Tax » Capitalmind - Better Investing

Capital Gains Tax Definition

Short term capital gains (STCG): Meaning, Income tax rate, Calculation

:max_bytes(150000):strip_icc()/costbasis.asp_final-4be425063ddb41648787429a607f098f.png)

Average Cost Basis Method: Definition, Calculation, Alternatives

Apa yang dimaksud dengan Keuntungan Modal atau Capital Gain? - Akuntansi - Dictio Community

Capital Gains: Meaning, Types, Taxation, Calculation, Exemptions

All Your Questions About Capital Gains and Taxes, Answered

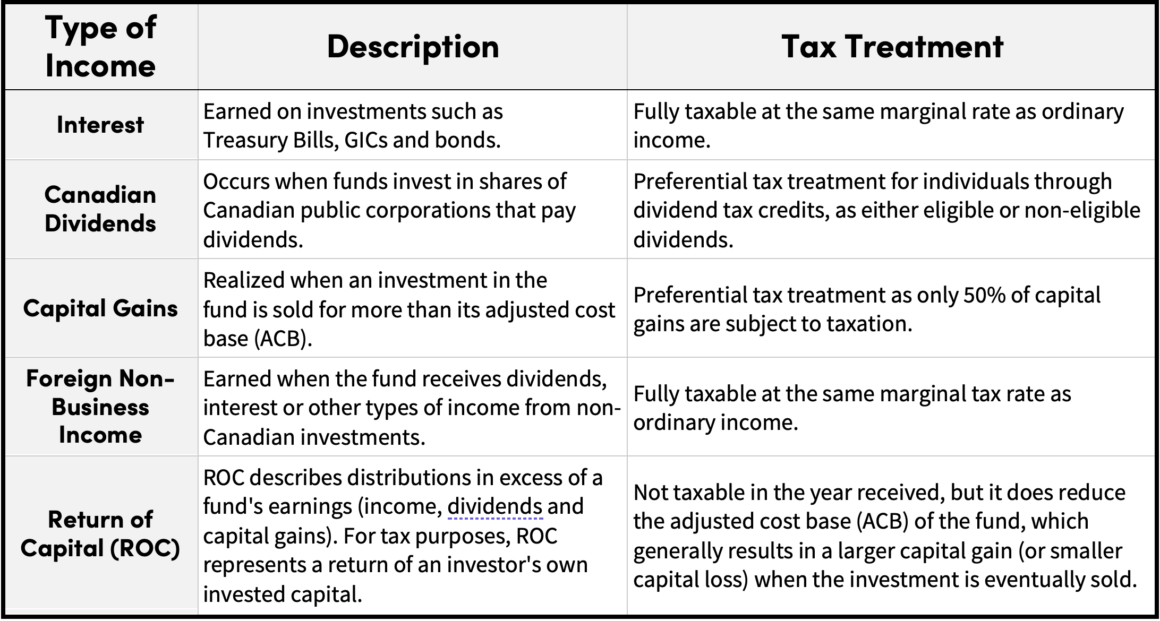

Tax implications of mutual fund distributions - Financial Pipeline

Investopedia on LinkedIn: We are pleased to announce that we have won the Gramercy Financial Content…

:max_bytes(150000):strip_icc()/INV_Tax_Tax-Efficient-d0fd1d1baf2d4920b4d6065ee5b89d41.png)

Income Tax vs. Capital Gains Tax: Differences