Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons

$ 12.50 · 4.7 (385) · In stock

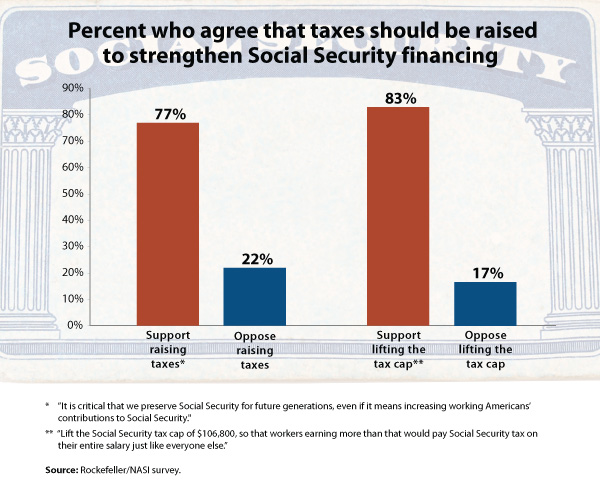

There have been a number of proposals to increase, eliminate, or otherwise adjust the payroll tax cap as a way to shore up Social Security’s finances.

Increasing Payroll Taxes Would Strengthen Social Security

Should I Have To Pay Tax On Earnings Through Bet365 - Betting

7 Ways to Pay Less Taxes on Social Security Benefits

Social Security COLA 2024 may impact your taxes in a big way

What is FICA tax? Understanding FICA for small business, fica tax

Social Security Expansion Act: $33.8 Trillion Tax Would Destroy Jobs, Slash Incomes, and Increase Workers' Dependence on the State

Americans agree on how to fix Social Security

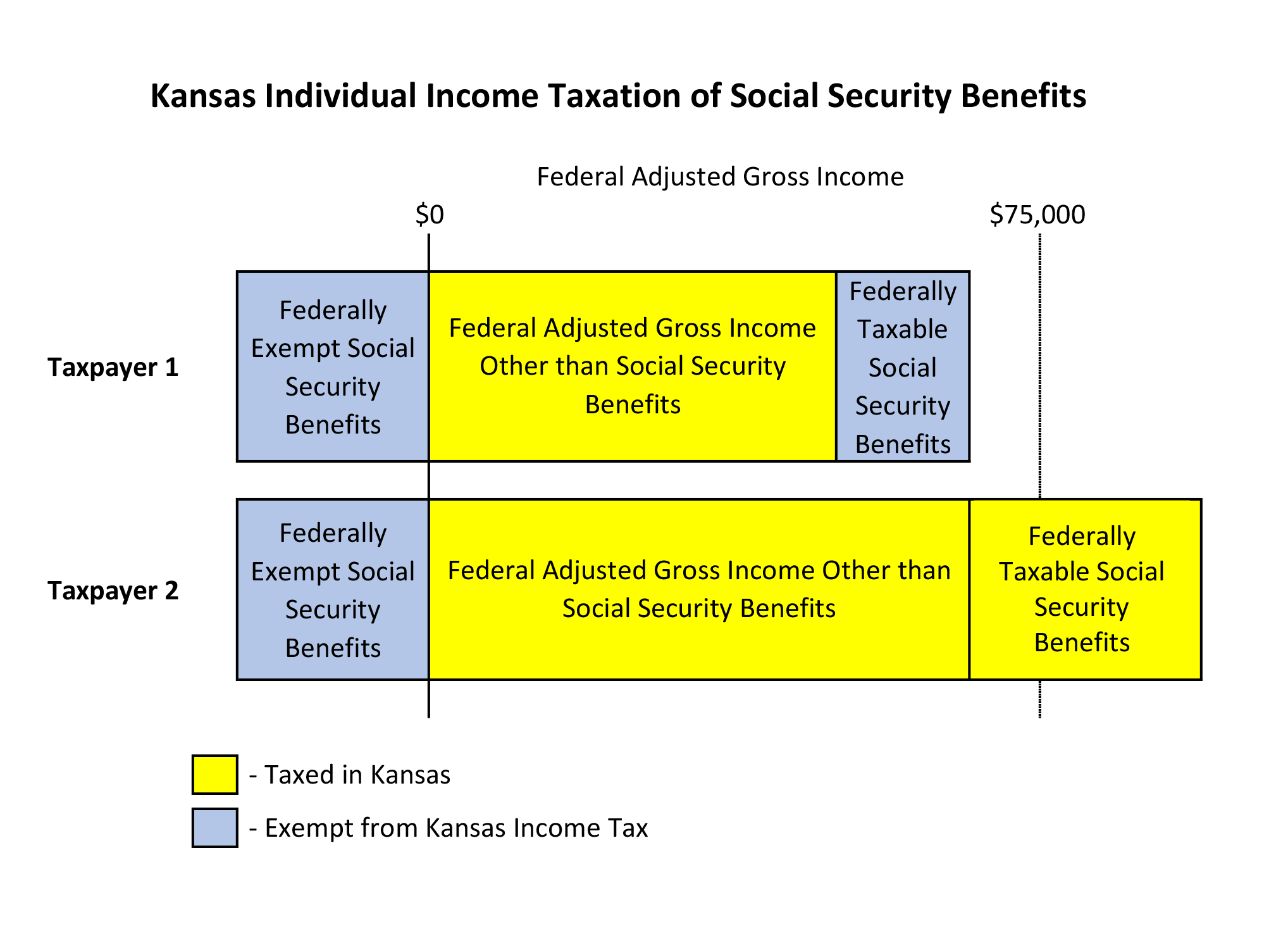

Income Taxation of Social Security Benefits – KLRD

How To Avoid Paying Taxes on Social Security Income

Dan Tumis (@Dtumis41) / X

Should We Eliminate the Social Security Tax Cap? Here Are the Pros and Cons