With IDB support, Banco do Brasil qualifies for sustainable bond market

$ 15.99 · 4.8 (590) · In stock

Banco do Brasil (BB), Latin America’s largest financial institution, completed its preparations to enter the market for sustainable bonds and has counted, for that, with the support of the Inter-American Development Bank (IDB). The objective is to seek the synergy between BB's experience in financin

Global Sustainable Bond Issuance To Surpass $1.5 Trillion In 2022

IDB Invest, Banco de Bogotá Announce First Sustainable, Subordinated Bond by a Colombian Bank

Untitled - Banco Mercantil

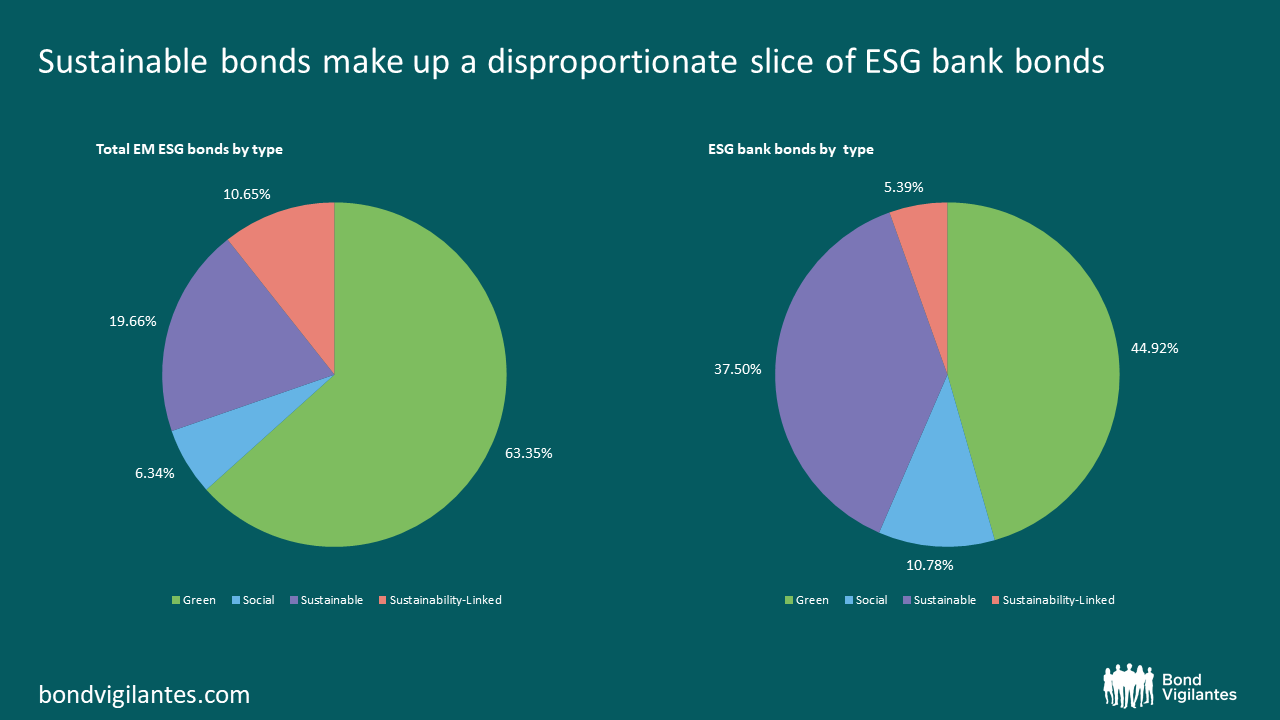

COVID-19 accelerates the issuance of sustainable EM bank bonds - Bond Vigilantes

Financial Integration in Latin America in: Policy Papers Volume 2016 Issue 023 (2016)

Unlocking the Power of Results-Based Financing to Tackle Development Challenges - Impacto

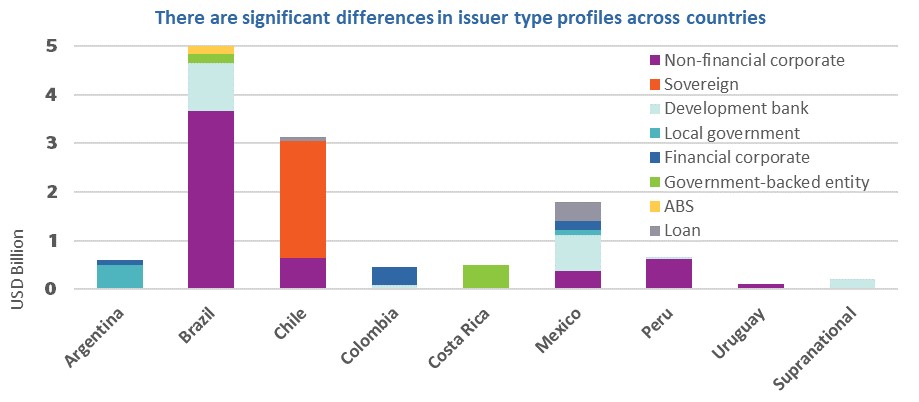

Latin America & Caribbean green finance: Huge potential across the region

bbdform20f_2014.htm - Generated by SEC Publisher for SEC Filing

BANK BRADESCO - UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 6-K REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Sovereign Sustainable Bonds as Core Financing Instruments for Sustainable Development

With IDB support, Banco do Brasil qualifies for sustainable bond market

Delivering on Sustainable Infrastructure for Better Development and Better Climate by Rodrigo Velasquez Angel - Issuu

Green Bonds

IDB Invest, Banco de Bogota announce $230 mln sustainability bond

bbdform20f_2016.htm - Generated by SEC Publisher for SEC Filing